Coordinated PO Closure

Works with the Invoice Co-Pilot to close purchase orders after processing.

Key Features

Automated PO closure validation

Tracks matched invoices against POs and automatically checks if the PO is ready to be closed, ensuring accurate closure and reducing manual follow-ups.

Real-time invoice tracking

Keeps PO status up to date by tracking invoiced quantities and amounts in real time, helping avoid early closures and ensuring accurate processing.

Multi-invoice handling

Handles multiple invoices by keeping POs open until all items are fully matched, ensuring accurate closure only after the final invoice is processed.

Manual closure option

Allows early PO closure through manual approval, giving teams control while ensuring the process aligns with internal policies.

Integration with invoice processing co-pilot

Works with the Invoice Co-Pilot to validate matched data, ensuring POs are only closed when all invoice details are accurate and complete.

Transparent notifications and reports

Sends automated updates and reports on PO closure status, highlighting reasons for closure or pending items to keep all stakeholders informed and aligned.

KEY BENEFITS

Procurement Co-Pilot shrinks cycle times from request to purchase order, freeing teams from manual effort, delivering instant ERP-synced approvals, and giving finance teams real-time spend visibility for compliant, cost-effective purchasing.

80%

PO creation & dispatch time

Converts approved PR into PO automatically based on the company's templates. It can send POs automatically to vendors based on configurations.

5min

PR creation time

Co-pilot auto-fills most of the complex forms in ERPs and procurement systems by reducing the effort to 5 minutes

Auditability

Human Errors

Approvals

PO Closing & Other KPIs

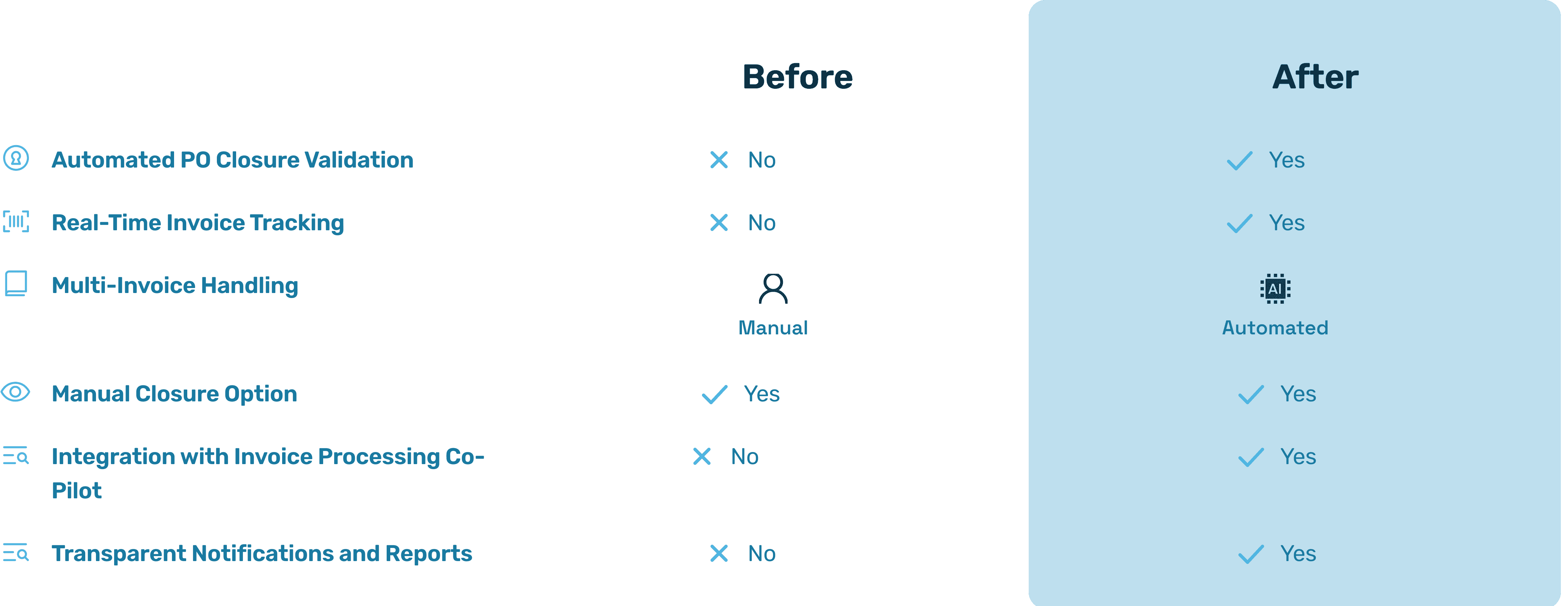

Before and After Hyperbots PR/PO Co-Pilot

FAQs: PO Closure

How is a One-Off PO closed by the Co-Pilot?

For one-off POs, the Co-Pilot closes the PO automatically after the invoice matching process confirms that the entire quantity and amount specified in the PO have been invoiced and processed.

How is a Blanket PO closed by the Co-Pilot?

The Co-Pilot tracks cumulative invoiced quantities and amounts for Blanket POs. It initiates closure once the PO’s validity period expires or when the maximum allowable quantity or amount has been reached.

Does PO closure happen after invoice processing or payment completion?

PO closure occurs after the invoice processing is completed and the invoice matches the PO details. It is not dependent on payment completion, as closure relates to the fulfillment of the PO terms.

What is partial PO closure?

Partial PO closure occurs when certain items or quantities within the PO are fulfilled and invoiced, while the rest remain open for future fulfillment. The Co-Pilot tracks and manages such partial closures automatically.

How do you manually close a PO?

POs can be manually closed through the Co-Pilot interface with appropriate approvals. This option is used when an organization decides to terminate a PO prematurely due to specific operational or policy reasons.

What communication happens on PO closure?

The Co-Pilot sends automated notifications to relevant stakeholders, including procurement and finance teams, informing them of the closure status, along with detailed reports on fulfilled quantities and amounts.

What happens to long-pending POs?

The Co-Pilot flags long-pending POs for review. Based on organizational policies, they can be closed manually or kept open if necessary. Notifications are sent to stakeholders to ensure action is taken on these POs.

Why Hyperbots Agentic AI Platform?

Finance specific

Hyperbots Agentic AI platform specializes exclusively in finance and accounting intelligence, leveraging millions of data points from invoices, statements, contracts, and other financial documents. No other platform has such large pretrained models on F&A data.

Best-in-class accuracy

Hyperbots achieves 99.8% accuracy in converting unstructured data to structured fields through a multimodal MOE model integrating LLMs, VLMs, and layout models. With contextual validation and augmentations, the platform ensures 100% accuracy for deployed agents.

Synthesis of unstructured and strutured finance data

Hyperbots agents emulate finance professionals to autonomously perform F&A tasks by reading and writing data like COA, expenses, and vendor masters from core accounting systems and integrating it with unstructured data from financial documents such as invoices, POs, and contracts.

Pre-trained agents with state of the art models

Hyperbots' Agentic platform, pre-trained on millions of financial documents like invoices, bills, statements, and contracts, ensures seamless integration, high accuracy, and adaptability to any accounting content, form, layout, or size from day one.

Company specific inference time learning

Hyperbots' Agentic platform employs state-of-the-art Auto ML pipelines with techniques like reinforcement learning to enable inference-time learning for tasks such as GL recommendation and cash outflow forecasting, ensuring continuous improvement and adaptability.