Achieve Upto 10% Savings on Payments While Improving Accuracy and Visibility

Curious how AI can automate payments, optimize timing, and eliminate manual errors? Discover the full journey below.

THE PROBLEM

Manual and inefficient payment processes lead to delayed payments, poor tracking, and strained vendor relationships. Missed early payment discounts, late payment penalties, and costly human errors quietly chip away at cash flow and operational efficiency, leaving finance teams overwhelmed and vendors frustrated.

Vendor relationship challenges

Poor payments tracking

Delayed payments

Late payment penalties

Missed early payment discounts

Over payments & human errors

THE SOLUTION

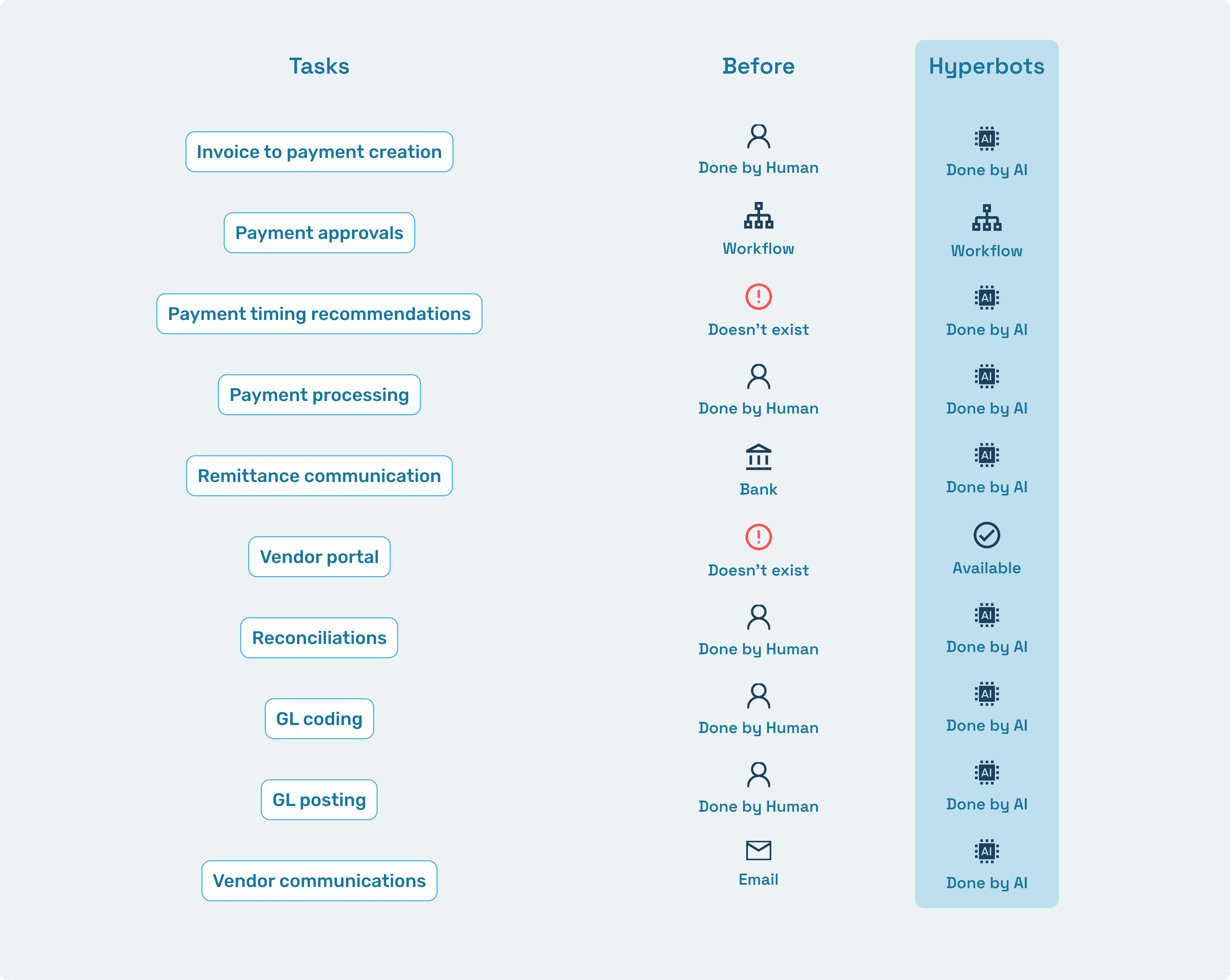

Hyperbots Payments Co-pilot automates payment processing with features like timing recommendations, approval workflows, and multi-method support (ACH, checks, wire transfers), ensuring secure, efficient, and compliant financial operations.

KEY BENEFITS

Payment Co-Pilot boosts cash flow by timing payments for discounts, routes approvals automatically for same-day releases, supports ACH, checks, and wire transfers with a full audit trail—delivering accurate, secure payments and tighter spend control.

10%

Cash outflow

Co-pilot optimizes payment timings and methods, analyzing payment terms, discounts, penalties and, cost of capital

Vendor satisfaction

Vendors have higher satisfaction as they know real-time status of invoice processing and payments

Auditability

Human errors

Approvals

Reconciliations & other KPIs

Key Functional Capabilities of Hyperbots Payments Co-Pilot

Payment timing recommendation for early payment discounts

Hyperbots Payments Co-Pilot analyzes discounts, terms, cost of capital, and vendor relationships to optimize payment timing, maximize savings, improve cash flow, and strengthen vendor partnerships.

Payment timing recommendations for penalty cases

Hyperbots Payments Co-Pilot analyzes penalties, cost of capital, and vendor relationships to optimize late payment decisions, balancing cost savings with vendor trust.

Payment approvals and flexible workflow

Hyperbots Payments Co-Pilot enables secure, flexible payment approvals through configurable workflows, real-time cash visibility, and tailored processes for senior finance executives.

Payment processing for ACH

Hyperbots Payments Co-Pilot automates secure ACH file generation with bank-specific formats, controlled access, and audit trails—streamlining payment processing while ensuring compliance, accuracy, and security at every step.

Payment processing for checks

Hyperbots Payments Co-Pilot automates check payments with customizable templates, secure handling, flexible printing options, and detailed audit trails—ensuring accuracy, compliance, and full accountability in every payment process.

Payment processing for other methods

Hyperbots Payments Co-Pilot supports wire transfers, credit cards, and digital wallets with secure processing, real-time reconciliation, and detailed audit trails—ensuring accuracy, speed, and full visibility across all payment methods.

Partial payments processing

Hyperbots Payments Co-Pilot supports flexible partial payments with configurable rules, automated reconciliation, and detailed audit trails—ensuring transparency, accuracy, and compliance across every payment transaction.

Reconciliations of invoices with bank payment transactions statements

Hyperbots Payments Co-Pilot automates invoice-to-bank reconciliation with AI-driven matching, anomaly detection, and real-time ERP updates—ensuring accuracy, transparency, and faster financial close

Reconciliations of cheques, status of cheque presentation, and invoices

Hyperbots Payments Co-Pilot automates check reconciliation with real-time updates, anomaly detection, and detailed audit trails—ensuring accuracy, transparency, and faster financial reporting.

Fraud prevention

Hyperbots Payments Co-Pilot prevents payment fraud with anomaly detection, duplicate checks, vendor validation, and secure audit trails—ensuring compliance, transparency, and protection across all payment processes.

GL posting of payments

Hyperbots Payments Co-Pilot integrates with ERPs to automate invoice posting and GL entries, using read-back validations to ensure accurate double-entry bookkeeping without manual effort or errors.

Remittance communication to vendors

Hyperbots Payments Co-Pilot automates remittance communication with customizable templates, multi-channel delivery, and detailed audit trails—ensuring clear, transparent, and consistent vendor interactions every time.

Notifications

Hyperbots Agentic AI generates contextual, real-time notifications throughout the entire accruals process—covering discovery, matching, workflows, GL coding, posting, and reversals—providing transparent updates, actionable insights, and timely user intervention opportunities.

Audit trails

Hyperbots Co-Pilot maintains a comprehensive audit trail capturing timestamps, actions, and data for every AI or human decision, ensuring full transparency for audits and reviews.

Pre-trained models

Hyperbots' payment processing Co-pilot, built on the Agentic AI platform, is pre-trained on bank statements and checks, ensuring quick integration, high accuracy, and adaptability to any reconciliation need from day one of going live.

Vendor portal

Hyperbots Payments Co-pilot provides real-time Payment status through a vendor portal, along with history, reports, and tools for collaboration with accounting staff on payments.

Multi-entity support

Hyperbots Payments Co-Pilot seamlessly integrates with multiple ERP systems and instances across various entities, providing a unified task view through Agentic AI and simplifying operations in complex, multi-ERP environments.

Unlimited access

Enjoy unlimited user access with no per-seat licensing—enabling seamless collaboration and effortless scalability across your organization.

Industry specific

Hyperbots provides industry-specific finance AI with customizable workflows, document handling, and tax validation—ensuring accurate, compliant processing tailored to sector-specific needs across industries like manufacturing, retail, healthcare, logistics, and more.

Company specific

Hyperbots enables no-code customization for company-specific needs—adapting workflows, ERP integrations, GL structures, and business rules through Agentic AI to ensure seamless alignment with organizational processes and finance operations.

Integrations

Hyperbots integrates seamlessly with ERPs, procurement platforms, and other enterprise systems—enabling real-time, secure, and scalable data exchange to power end-to-end AI automation across finance and operations

24X7

Hyperbots Co-pilots run 24x7—automating invoice workflows, monitoring tasks, and alerting humans only when needed. This ensures uninterrupted operations, faster turnaround, and continuous productivity across finance and procurement teams.

Human-in-the-loop

Hyperbots Co-pilots enable human-in-the-loop collaboration through exception handling, approval workflows, and contextual insights—ensuring control, transparency, and continuous learning where human judgment adds value.

Process specific

Powered by Agentic AI, Hyperbots Co-pilots deliver process-specific automation through domain-trained models and collaborative agents—ensuring scalability, precision, and efficiency across finance operations like invoicing, approvals, and GL coding.

Self learning

Hyperbots Co-pilots use self-learning AI to adapt to company-specific workflows, improve accuracy over time, and continuously align with changing business rules, exceptions, and process variations—driving smarter automation with every interaction.

Intelligence elements

Built on the Agentic AI platform, Hyperbots Co-pilots combine OCR, LLMs, VLMs, MOE, reasoning, redaction, math interpretation, and predictive engines to deliver intelligent, efficient automation across complex finance workflows.

Functional elements

Hyperbots Co-pilots offer functional elements like workflows, notifications, security, analytics, SSO, audit trails, user portals, permissions, and observability—ensuring secure, configurable, and auditable operations across teams and systems.

Ready to deploy

Hyperbots Co-pilots are ready-to-deploy, no-code solutions with pre-trained AI agents and native ERP connectors—enabling rapid, customized setup without third-party integrations or development overhead.

AI-native

Hyperbots Co-pilots are AI-native by design—built from the ground up for finance automation, delivering purpose-built precision, transformative productivity, and measurable value across accounting, invoicing, and approval workflows.

Why Hyperbots Agentic AI Platform?

Finance specific

Hyperbots Agentic AI platform specializes exclusively in finance and accounting intelligence, leveraging millions of data points from invoices, statements, contracts, and other financial documents. No other platform has such large pretrained models on F&A data.

Best-in-class accuracy

Hyperbots achieves 99.8% accuracy in converting unstructured data to structured fields through a multimodal MOE model integrating LLMs, VLMs, and layout models. With contextual validation and augmentations, the platform ensures 100% accuracy for deployed agents.

Synthesis of unstructured and strutured finance data

Hyperbots agents emulate finance professionals to autonomously perform F&A tasks by reading and writing data like COA, expenses, and vendor masters from core accounting systems and integrating it with unstructured data from financial documents such as invoices, POs, and contracts.

Pre-trained agents with state of the art models

Hyperbots' Agentic platform, pre-trained on millions of financial documents like invoices, bills, statements, and contracts, ensures seamless integration, high accuracy, and adaptability to any accounting content, form, layout, or size from day one.

Company specific inference time learning

Hyperbots' Agentic platform employs state-of-the-art Auto ML pipelines with techniques like reinforcement learning to enable inference-time learning for tasks such as GL recommendation and cash outflow forecasting, ensuring continuous improvement and adaptability.