Payment Timing Aligned with Terms and Cash Flow

Analyzes payment terms, vendor context, and cash flow impact to recommend when to pay, balancing discounts, penalties, and priorities.

Key Features

Penalty analysis for late payments

Checks potential late fees and weighs them against your cost of capital to suggest if delaying a payment makes financial sense.

Vendor delivery criticality assessment

Looks at how essential a vendor’s delivery is to the operations and suggests if a payment can be safely delayed without disrupting business.

Vendor relationship evaluation

Uses past interactions to understand how flexible a vendor is with late payments, helping making decisions that keep the relationship strong.

No penalty scenarios

Spots situations where delaying a payment won’t lead to penalties and hence help manage cash flow without added cost.

Cost of capital consideration

Helps decide when it’s better to hold onto cash by comparing potential penalties with the cost of capital, so payments are timed with financial efficiency in mind.

Historical data insights

Looks at past payment patterns and vendor responses to suggest when late payments are acceptable, without risking relationships.

Dynamic recommendation updates

Keeps an eye on changing penalties, vendor priorities, and cash flow to update payment suggestions as things shift, so decisions stay timely and relevant.

KEY BENEFITS

Payment Co-Pilot boosts cash flow by timing payments for discounts, routes approvals automatically for same-day releases, supports ACH, checks, and wire transfers with a full audit trail—delivering accurate, secure payments and tighter spend control.

10%

Cash outflow

Co-pilot optimizes payment timings and methods, analyzing payment terms, discounts, penalties and, cost of capital

Vendor satisfaction

Vendors have higher satisfaction as they know real-time status of invoice processing and payments

Auditability

Human errors

Approvals

Reconciliations & other KPIs

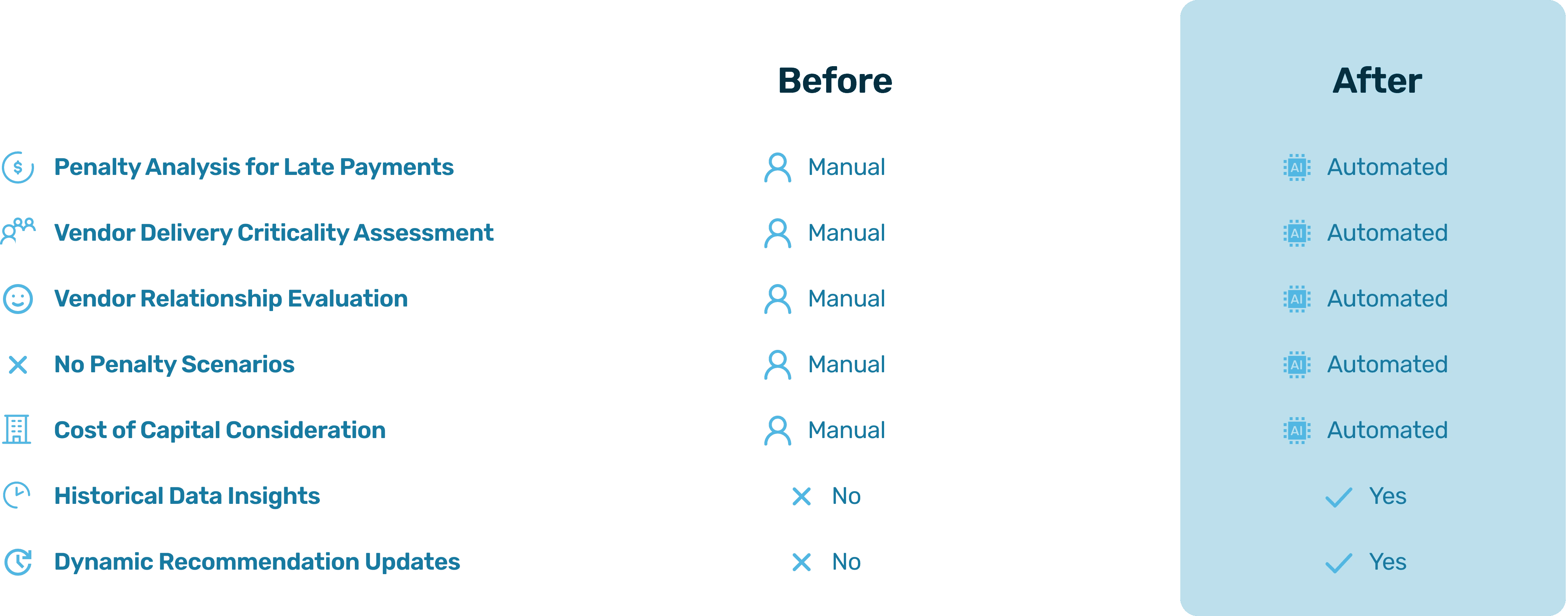

Before and After Hyperbots Payments

Co-Pilot

Why Hyperbots Agentic AI Platform?

Finance specific

Hyperbots Agentic AI platform specializes exclusively in finance and accounting intelligence, leveraging millions of data points from invoices, statements, contracts, and other financial documents. No other platform has such large pretrained models on F&A data.

Best-in-class accuracy

Hyperbots achieves 99.8% accuracy in converting unstructured data to structured fields through a multimodal MOE model integrating LLMs, VLMs, and layout models. With contextual validation and augmentations, the platform ensures 100% accuracy for deployed agents.

Synthesis of unstructured and strutured finance data

Hyperbots agents emulate finance professionals to autonomously perform F&A tasks by reading and writing data like COA, expenses, and vendor masters from core accounting systems and integrating it with unstructured data from financial documents such as invoices, POs, and contracts.

Pre-trained agents with state of the art models

Hyperbots' Agentic platform, pre-trained on millions of financial documents like invoices, bills, statements, and contracts, ensures seamless integration, high accuracy, and adaptability to any accounting content, form, layout, or size from day one.

Company specific inference time learning

Hyperbots' Agentic platform employs state-of-the-art Auto ML pipelines with techniques like reinforcement learning to enable inference-time learning for tasks such as GL recommendation and cash outflow forecasting, ensuring continuous improvement and adaptability.

FAQs: Late Payment Recommendations

How does the Co-pilot analyze penalties for late payments?

The Co-pilot evaluates penalty charges for delayed payments and compares them with the company’s cost of capital to recommend whether delaying payments is financially viable.

Does the Co-pilot consider vendor criticality when recommending late payments?

Yes, it assesses the impact of vendor deliveries on business operations and prioritizes late payments for non-critical vendors to minimize operational risks.

How does the Co-pilot evaluate vendor relationships for late payments?

It uses historical data to assess vendor tolerance for late payments, ensuring recommendations align with maintaining strong relationships and trust.

What scenarios does the Co-pilot identify for penalty-free late payments?

The Co-pilot flags cases where late payments incur no penalties, allowing businesses to optimize cash flow without financial consequences.

How does the Co-pilot incorporate cost of capital into late payment decisions?

It recommends delaying payments when the penalty is lower than the company’s cost of capital, ensuring optimal use of financial resources.

Can the Co-pilot update recommendations based on changing conditions?

Yes, the Co-pilot dynamically updates recommendations by monitoring changes in penalties, vendor status, and cash flow, ensuring real-time decision-making.

Give an example of when a late payment might not make sense.

If the penalty is 2% for every 15 days of delay and the company’s cost of capital is 10% annually, late payment would not make sense. The annualized penalty is 24% (2% × 12), which is higher than the cost of capital, making it uneconomical to delay payment.