Tracking Vendor Payment Actions with Agentic AI

Records all activity, automated or manual, across approvals, reconciliation, and payment processing to support transparency and control.

Key Features

Comprehensive action logging

Captures every step, creation, approval, rejection, payment, remittance, and reconciliation, for complete visibility and traceability.

Timestamps for Each Step

Each action in the audit trail is time-stamped to provide clear visibility into when every step took place.

Human and AI Actions Differentiated

Easily distinguishes between AI-driven and human actions, so it’s clear who did what at every step.

Associated Data Points Logged

Each action is logged with key details, like approver name, comments, time taken, and any matching discrepancies, ensuring full context.

Transparent Workflow Tracking

Gives a clear end-to-end view of the accruals process, helping identify steps, spot issues, and resolve bottlenecks.

UI Presentation with Audit Trail Cards

Audit logs are displayed as easy-to-read cards in the Co-pilot’s UI, giving users clear visibility into every action taken.

KEY BENEFITS

Payment Co-Pilot boosts cash flow by timing payments for discounts, routes approvals automatically for same-day releases, supports ACH, checks, and wire transfers with a full audit trail—delivering accurate, secure payments and tighter spend control.

10%

Cash outflow

Co-pilot optimizes payment timings and methods, analyzing payment terms, discounts, penalties and, cost of capital

Vendor satisfaction

Vendors have higher satisfaction as they know real-time status of invoice processing and payments

Auditability

Human errors

Approvals

Reconciliations & other KPIs

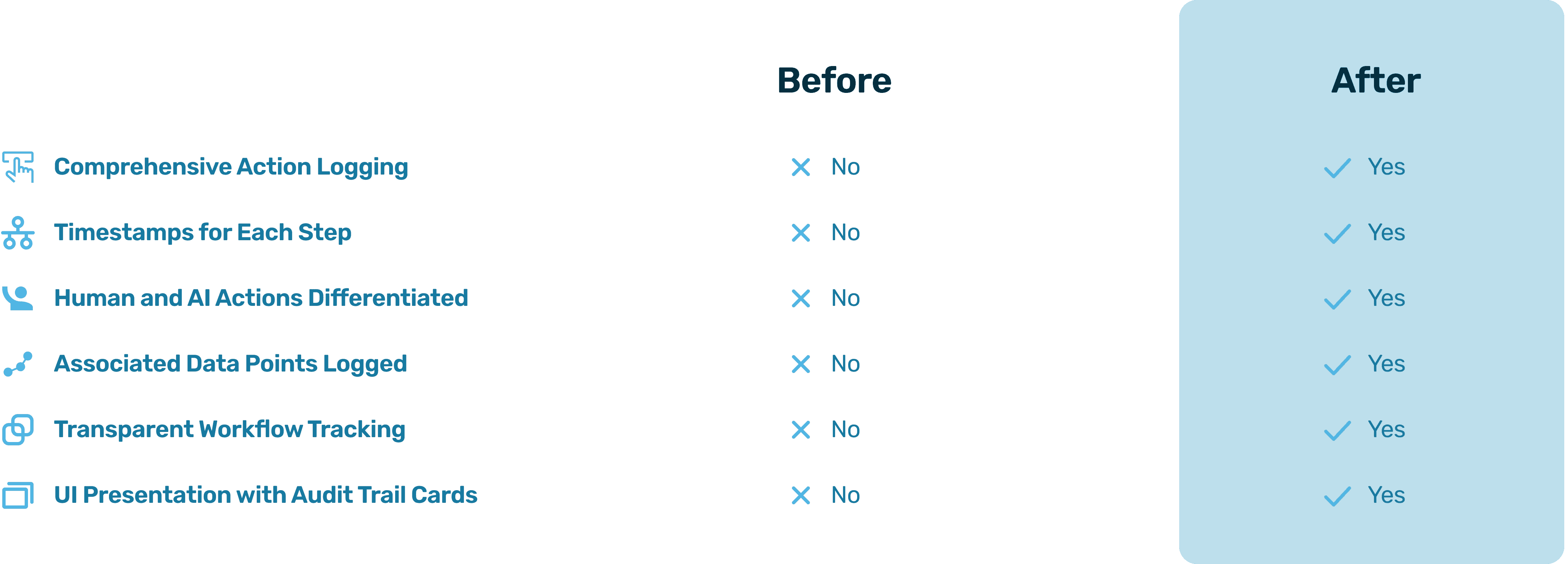

Before and After Hyperbots Payments Co-Pilot

Why Hyperbots Agentic AI Platform?

Finance specific

Hyperbots Agentic AI platform specializes exclusively in finance and accounting intelligence, leveraging millions of data points from invoices, statements, contracts, and other financial documents. No other platform has such large pretrained models on F&A data.

Best-in-class accuracy

Hyperbots achieves 99.8% accuracy in converting unstructured data to structured fields through a multimodal MOE model integrating LLMs, VLMs, and layout models. With contextual validation and augmentations, the platform ensures 100% accuracy for deployed agents.

Synthesis of unstructured and strutured finance data

Hyperbots agents emulate finance professionals to autonomously perform F&A tasks by reading and writing data like COA, expenses, and vendor masters from core accounting systems and integrating it with unstructured data from financial documents such as invoices, POs, and contracts.

Pre-trained agents with state of the art models

Hyperbots' Agentic platform, pre-trained on millions of financial documents like invoices, bills, statements, and contracts, ensures seamless integration, high accuracy, and adaptability to any accounting content, form, layout, or size from day one.

Company specific inference time learning

Hyperbots' Agentic platform employs state-of-the-art Auto ML pipelines with techniques like reinforcement learning to enable inference-time learning for tasks such as GL recommendation and cash outflow forecasting, ensuring continuous improvement and adaptability.

FAQs: Audit Trails for Payments

How does the Hyperbots Co-Pilot maintain a detailed log of actions during the payment process?

The Co-Pilot records every step in the payment cycle, including payment creation, modification, approval, remittance communication, reconciliation, and issue resolution.

Can the audit trail differentiate between actions taken by AI and humans?

Yes, the Co-Pilot clearly identifies whether an action was performed by AI or a human, ensuring accountability and transparency for both automated and manual tasks.

What kind of data points are logged in the payment audit trail?

The audit trail logs critical details such as approver names, timestamps, human action durations, payment modifications, and discrepancies flagged by AI, providing a comprehensive record.

How does the audit trail help users track the progress of payments?

The trail provides an end-to-end view of the payment process, tracking each step, highlighting bottlenecks, and allowing users to review the status and history of every payment.

How are these audit logs presented to users in the Co-Pilot’s interface?

The Co-Pilot displays audit logs as interactive Audit Trail Cards, enabling users to access detailed, organized information about every action in the payment process with ease.

Designed by CFOs for CFOs

We worked with several CFOs to solve the right problems.

Hear what they have to say!