Automated ACH Payments with Control and Traceability

Automates ACH payment file creation, applies bank-specific formatting, restricts access to authorized roles, and maintains detailed audit trails for transparency and control.

Key Features

Automated ACH file generation

Once payments are approved, the Co-pilot creates ACH files automatically, removing the need for manual file preparation.

Secure file handling

ACH files are created and stored with built-in safeguards, following industry standards to keep payment data protected at every step.

Customizable bank file format

ACH files can be tailored to match the specific format requirements of each bank, making payment processing smooth and error-free.

Authorized access for file downloads

ACH files can only be downloaded by approved finance team members, helping maintain control and security over payment data.

Simplified bank portal uploads

Generated files are formatted for direct upload to the bank’s portal, making the payment process quicker and easier.

Audit trail for ACH payments

Keeps a complete record of all ACH activity, like file creation, downloads, and uploads, for transparency and compliance.

KEY BENEFITS

Payment Co-Pilot boosts cash flow by timing payments for discounts, routes approvals automatically for same-day releases, supports ACH, checks, and wire transfers with a full audit trail—delivering accurate, secure payments and tighter spend control.

10%

Cash outflow

Co-pilot optimizes payment timings and methods, analyzing payment terms, discounts, penalties and, cost of capital

Vendor satisfaction

Vendors have higher satisfaction as they know real-time status of invoice processing and payments

Auditability

Human errors

Approvals

Reconciliations & other KPIs

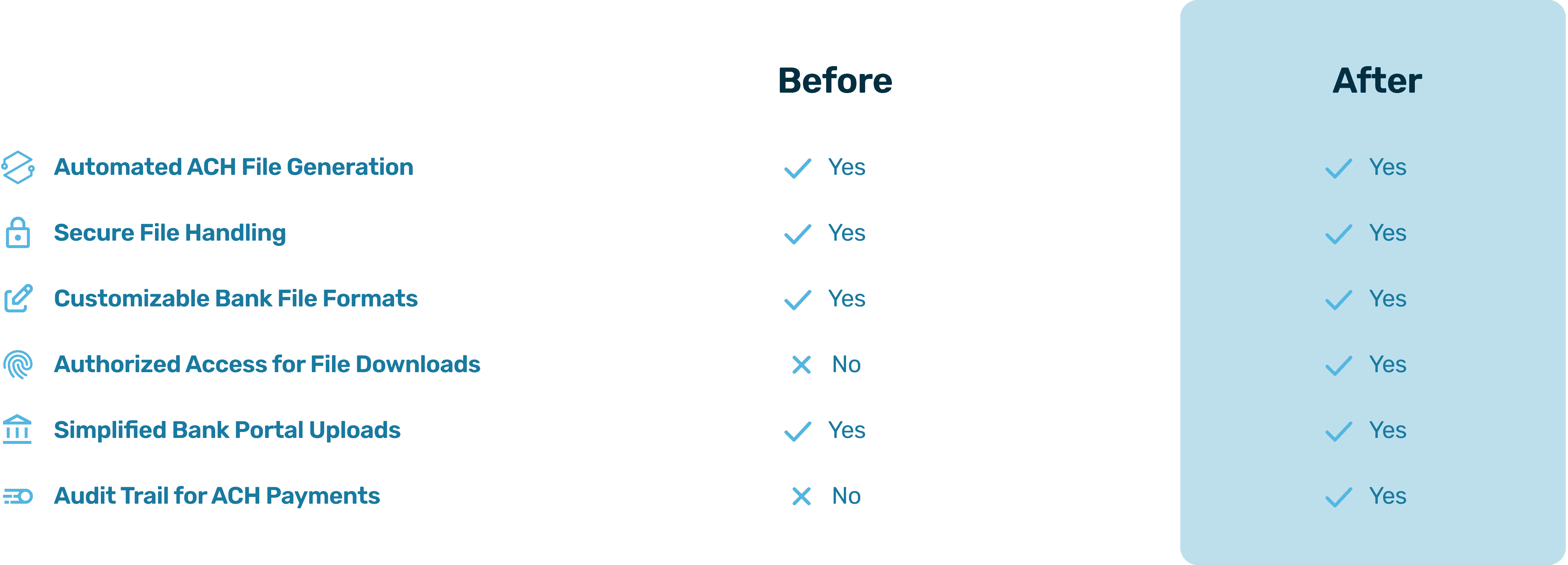

Before and After Hyperbots Payments Co-Pilot

Why Hyperbots Agentic AI Platform?

Finance specific

Hyperbots Agentic AI platform specializes exclusively in finance and accounting intelligence, leveraging millions of data points from invoices, statements, contracts, and other financial documents. No other platform has such large pretrained models on F&A data.

Best-in-class accuracy

Hyperbots achieves 99.8% accuracy in converting unstructured data to structured fields through a multimodal MOE model integrating LLMs, VLMs, and layout models. With contextual validation and augmentations, the platform ensures 100% accuracy for deployed agents.

Synthesis of unstructured and strutured finance data

Hyperbots agents emulate finance professionals to autonomously perform F&A tasks by reading and writing data like COA, expenses, and vendor masters from core accounting systems and integrating it with unstructured data from financial documents such as invoices, POs, and contracts.

Pre-trained agents with state of the art models

Hyperbots' Agentic platform, pre-trained on millions of financial documents like invoices, bills, statements, and contracts, ensures seamless integration, high accuracy, and adaptability to any accounting content, form, layout, or size from day one.

Company specific inference time learning

Hyperbots' Agentic platform employs state-of-the-art Auto ML pipelines with techniques like reinforcement learning to enable inference-time learning for tasks such as GL recommendation and cash outflow forecasting, ensuring continuous improvement and adaptability.

FAQs: Payment Processing By ACH

How does the Co-pilot handle ACH file generation?

The Co-pilot automatically generates ACH files for payments based on approved payment instructions, ensuring seamless processing for vendor payments.

Are ACH files created securely?

Yes, ACH files are encrypted during generation and transfer, complying with industry standards to ensure secure handling and data protection.

Can the Co-pilot generate ACH files specific to different banks?

Absolutely, the Co-pilot supports customizable bank file formats, allowing companies to generate ACH files tailored to the requirements of various banks.

Who can access and download ACH files?

Only authorized finance staff with appropriate roles can download ACH files, maintaining security and accountability in the payment process.

Can multiple ACH files be generated at the same time based on vendors and banks?

Yes, the Co-pilot can generate multiple ACH files simultaneously, segregating them by vendors and banks to streamline payment processing.

Does the Co-pilot maintain a record of ACH payment actions?

Yes, the Co-pilot provides a detailed audit trail of all ACH-related actions, including file generation, downloads, and uploads, ensuring transparency and traceability.