Real-Time Sales Tax Validation with Agentic AI

Detects mismatches between calculated and invoiced tax amounts, down to individual line items, enabling faster resolution and clean audit trails.

Key Features

Automated tax calculation comparison

Automatically compares calculated tax with what’s shown on the invoice, based on item type, location, and details, and flags any differences for review.

Real-time validation checks

Checks for mismatches while the invoice is being processed and notifies users right away, so issues can be fixed early and compliance is maintained.

Granular discrepancy detection

Identifies wrong rates or amounts at both the overall and line-item level, making it easier to spot and fix specific issues quickly.

Dynamic threshold & rule setting

Custom thresholds and rules can be defined to focus alerts on meaningful discrepancies while minimizing false positives from minor differences.

Exception reporting & alerts

Creates clear reports and sends alerts when exceptions are found, helping ensure timely reviews and accurate invoice processing.

KEY BENEFITS

Hyperbots Sales Tax Verification Co-Pilot locks in sales-tax compliance on every invoice, shutting down tax underpayment penalties before they start. A built-in, time-stamped trail delivers effortless auditability, while near-zero human errors protect margins and, ultimately, your company’s reputation for accuracy and integrity.

Sales tax compliance

Co-pilot verifies applicable sales tax for every invoice and line item automatically

Tax underpayment

Co-pilot acts as a preventive method against over or under-charged sales tax by vendors

Auditability

Human errors

Reputation

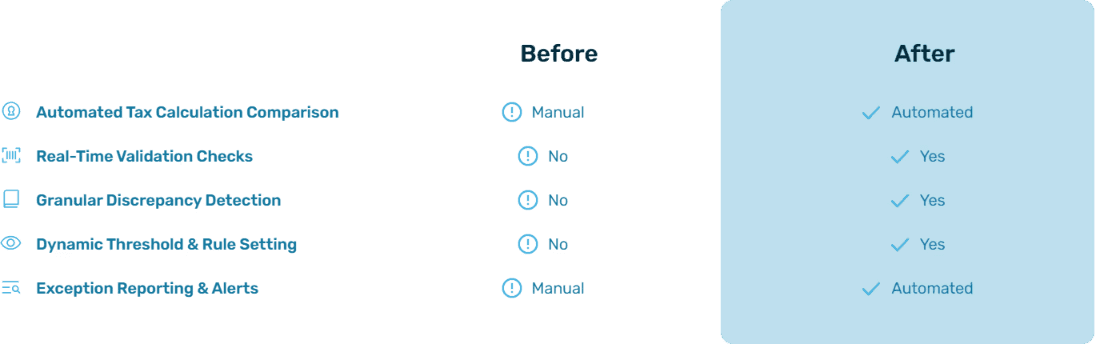

Before and After Hyperbots Sales Tax Verification Co-Pilot

Why Hyperbots Agentic AI Platform?

Finance specific

Hyperbots Agentic AI platform specializes exclusively in finance and accounting intelligence, leveraging millions of data points from invoices, statements, contracts, and other financial documents. No other platform has such large pretrained models on F&A data.

Best-in-class accuracy

Hyperbots achieves 99.8% accuracy in converting unstructured data to structured fields through a multimodal MOE model integrating LLMs, VLMs, and layout models. With contextual validation and augmentations, the platform ensures 100% accuracy for deployed agents.

Synthesis of unstructured and strutured finance data

Hyperbots agents emulate finance professionals to autonomously perform F&A tasks by reading and writing data like COA, expenses, and vendor masters from core accounting systems and integrating it with unstructured data from financial documents such as invoices, POs, and contracts.

Pre-trained agents with state of the art models

Hyperbots' Agentic platform, pre-trained on millions of financial documents like invoices, bills, statements, and contracts, ensures seamless integration, high accuracy, and adaptability to any accounting content, form, layout, or size from day one.

Company specific inference time learning

Hyperbots' Agentic platform employs state-of-the-art Auto ML pipelines with techniques like reinforcement learning to enable inference-time learning for tasks such as GL recommendation and cash outflow forecasting, ensuring continuous improvement and adaptability.

FAQs: Identification and Reporting of Tax Mismatches

How does the system compare expected tax amounts to invoiced amounts through Automated Tax Calculation Comparison?

It calculates expected tax (based on product/service type, jurisdiction, and line items) and compares it to the invoiced tax, automatically flagging any differences.

Why are Real-Time Validation Checks important, and how do they help prevent non-compliance?

They identify mismatches during invoice processing, allowing immediate fixes and reducing the risk of incorrect filings or penalties.

In what ways does Granular Discrepancy Detection isolate mismatches at both the total and line-item level?

The Co-pilot checks both overall invoice totals and each line item’s tax details, making it easier to find and correct specific errors.

How does Dynamic Threshold & Rule Setting allow users to tailor the significance of detected mismatches?

A4: Users set their own tolerance levels or rules, so only meaningful discrepancies are flagged, reducing false alarms.

What role do Exception Reporting & Alerts play in ensuring timely corrections to tax discrepancies?

The system generates concise reports and sends alerts when mismatches occur, speeding up reviews and ensuring quick resolution.

How do these features collectively streamline the process of identifying and resolving tax errors in invoices?

Automated comparisons, immediate checks, targeted detection, custom thresholds, and quick notifications work together to spot errors fast and guide prompt corrections.