Unified Task View Across ERPs and Entities

Connects multiple ERP instances to streamline sales-tax workflows, invoice matching, and journal entries.

Key Features

Support for multiple ERPs

Works smoothly across ERPs like NetSuite, SAP, and QuickBooks, automatically activating the right connectors for each entity. No need for expensive system changes.

Support for multiple instances of the same ERP

Easily manages multiple instances of the same ERP, supporting both shared and separate general ledgers, while allowing unified or customized processes for each entity.

Single sign-on for multi-ERP access

Single sign-on enables smooth access to Co-Pilots across all ERPs and entities, removing the need for separate logins and simplifying navigation for finance teams.

Unified business processes across entities

Replicates configurations across ERPs and ledgers to standardize workflows, rules, and reporting, helping maintain consistency across all entities.

Tailored processes for distinct entities

Co-Pilots support entity-specific setups, allowing each business unit to run its own workflows, rules, and reporting, without needing to align with other entities.

Flexibility for centralized or separate teams

Supports both centralized teams with shared access and separate teams working at the entity level, allowing flexibility based on how the organization is structured.

KEY BENEFITS

Hyperbots Sales Tax Verification Co-Pilot locks in sales-tax compliance on every invoice, shutting down tax underpayment penalties before they start. A built-in, time-stamped trail delivers effortless auditability, while near-zero human errors protect margins and, ultimately, your company’s reputation for accuracy and integrity.

Sales tax compliance

Co-pilot verifies applicable sales tax for every invoice and line item automatically

Tax underpayment

Co-pilot acts as a preventive method against over or under-charged sales tax by vendors

Auditability

Human errors

Reputation

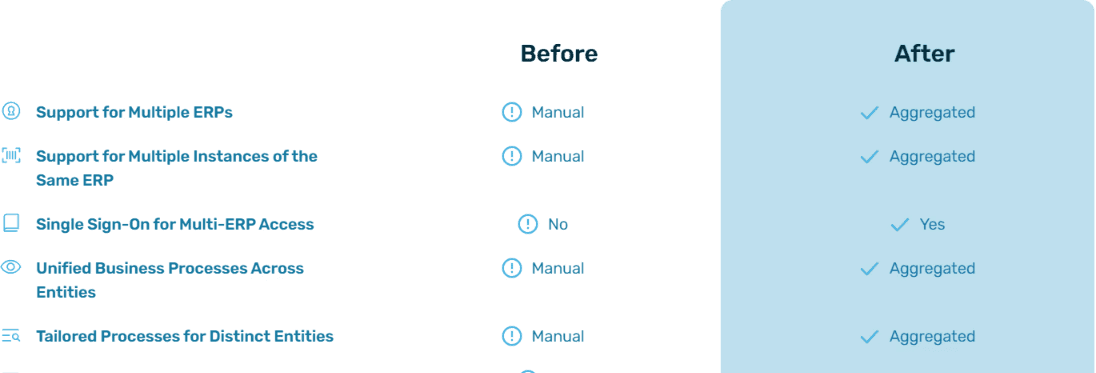

Before and After Hyperbots Sales Tax Verification Co-Pilot

Why Hyperbots Agentic AI Platform?

Finance specific

Hyperbots Agentic AI platform specializes exclusively in finance and accounting intelligence, leveraging millions of data points from invoices, statements, contracts, and other financial documents. No other platform has such large pretrained models on F&A data.

Best-in-class accuracy

Hyperbots achieves 99.8% accuracy in converting unstructured data to structured fields through a multimodal MOE model integrating LLMs, VLMs, and layout models. With contextual validation and augmentations, the platform ensures 100% accuracy for deployed agents.

Synthesis of unstructured and strutured finance data

Hyperbots agents emulate finance professionals to autonomously perform F&A tasks by reading and writing data like COA, expenses, and vendor masters from core accounting systems and integrating it with unstructured data from financial documents such as invoices, POs, and contracts.

Pre-trained agents with state of the art models

Hyperbots' Agentic platform, pre-trained on millions of financial documents like invoices, bills, statements, and contracts, ensures seamless integration, high accuracy, and adaptability to any accounting content, form, layout, or size from day one.

Company specific inference time learning

Hyperbots' Agentic platform employs state-of-the-art Auto ML pipelines with techniques like reinforcement learning to enable inference-time learning for tasks such as GL recommendation and cash outflow forecasting, ensuring continuous improvement and adaptability.

FAQs: Multi Entity Support for Sales Tax Verification

How does the Co-Pilot handle organizations using multiple ERPs?

The Co-Pilot seamlessly integrates with various ERPs like NetSuite, SAP, and QuickBooks, activating the appropriate connectors for each entity. This ensures consistent task execution without requiring costly ERP migrations or standardizations.

Can the Co-Pilot work with multiple instances of the same ERP across entities?

Yes, it supports multiple instances of ERPs like SAP or NetSuite, interacting with each instance to perform tasks. It allows for unified processes or tailored setups based on whether entities share a replicated GL or maintain distinct GLs.

How does single sign-on simplify access for finance teams managing multiple ERPs or entities?

Single sign-on provides seamless access to the Co-Pilot across all ERPs and entities, eliminating the need for repeated logins and enhancing efficiency for finance teams managing diverse systems.

Can the Co-Pilot standardize processes across entities with different ERPs and GLs?

Absolutely. The Co-Pilot replicates configurations across entities, standardizing workflows, authority matrices, exception handling, and analytics while ensuring ERP data consistency through connectors.

Does the Co-Pilot support entity-specific configurations for distinct processes?

Yes, the Co-Pilot fully supports unique configurations for entities requiring distinct workflows, rules, and analytics. It ensures tailored process management while keeping ERP data entity-specific.